When most investors think about building wealth, they turn to the stock exchange. Shares, bonds, and ETFs dominate financial conversations. Yet outside the trading floor, other asset classes are gaining recognition — including rare collectibles. Among them, Polish 1994 banknotes have quietly become one of the most compelling niches for investors who understand scarcity and long-term value.

The first series of the new złoty

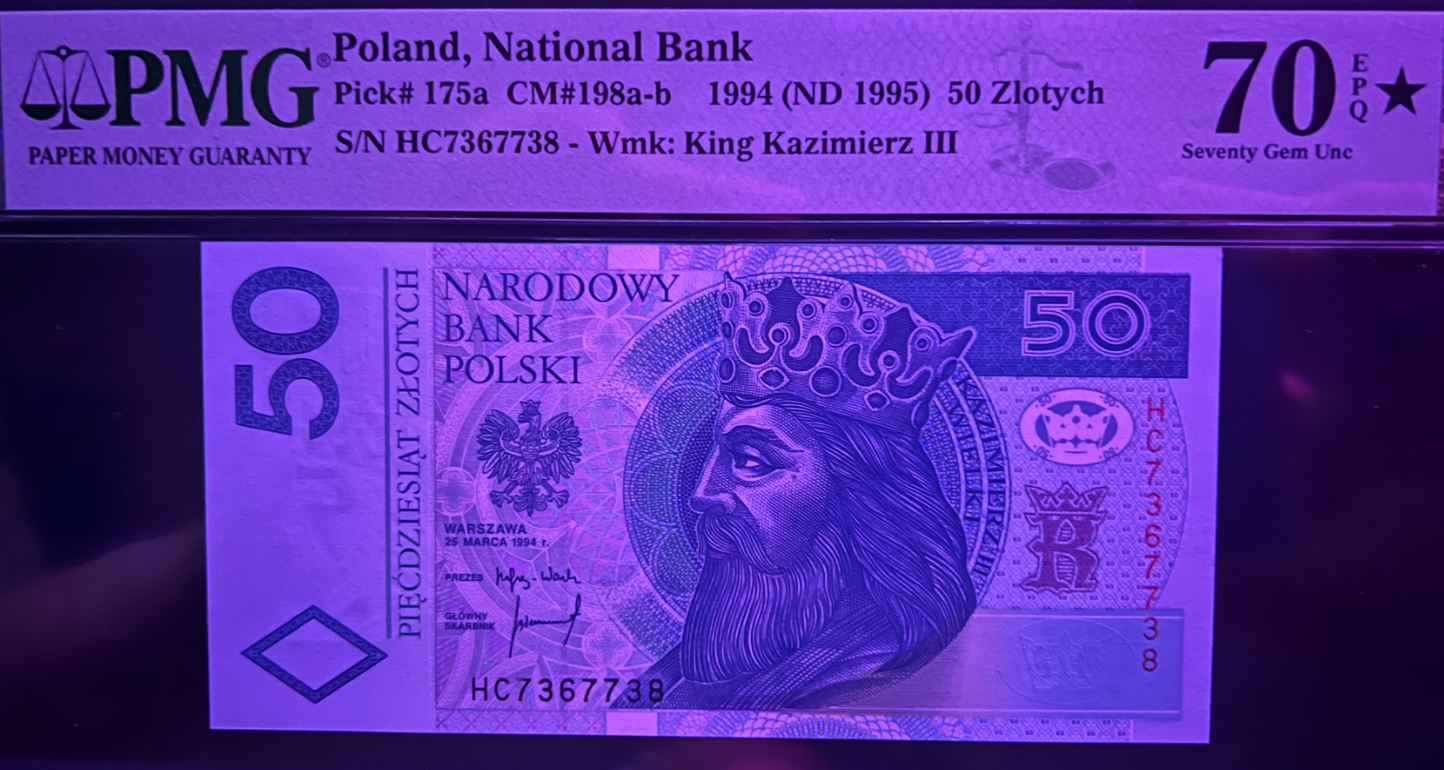

The 1994 issue marked Poland’s transition to a stable currency. As the first series of the modern złoty (PLN), these notes have historical weight. Collectors and investors prize them not only for their symbolism but also for their unique production background. Within this series exist specimen banknotes and printing variants that are not listed in standard catalogs. Scarcity is the key — and scarcity is exactly what investors look for when diversifying beyond traditional securities.

Why banknotes behave like assets

Rare banknotes can be compared to alternative investments such as art or fine wine. They share the same features: limited supply, strong collector demand, and value growth that is largely independent of stock market volatility. In times of inflation or uncertainty, tangible assets often outperform expectations. Owning an unlisted specimen from the 1994 series can provide the same hedge effect as owning physical gold — except the upside comes from numismatic rarity.

Unlisted variants and discovery value

Traditional catalogs like Czesław Milczak’s listings or the global Pick Standard Catalog do not capture every variation. That’s where the discovery premium comes in. Notes with unusual prefixes, missing overprints, or stamps such as the “NO VALUE” from the London printer TDLR, represent opportunities. They are “white ravens” of the numismatic world — once verified and publicized, they can multiply in value much faster than more common issues.

Complementing a stock portfolio

Adding collectibles to an investment strategy is not about abandoning equities or bonds. It’s about diversification. While the stock exchange reacts daily to interest rates, corporate earnings, and geopolitical news, a unique 1994 specimen banknote follows its own market rhythm. Auction records, collector demand, and the sheer impossibility of increasing supply drive prices. This uncorrelated behavior can stabilize a portfolio and offer upside that traditional analysts overlook.

Where to learn more

Investors interested in exploring this field further can review documented examples, images, and research at 1994.pl. The site showcases rare Polish 1994 banknotes that have never been listed on OneBid, Heritage Auctions, or PMG populations. For serious collectors and investors alike, it is the reference point for understanding why these notes represent more than just currency — they represent enduring value.

Conclusion

The stock exchange will always remain the backbone of modern investing. But as savvy investors know, true resilience comes from diversification. Polish 1994 banknotes are not a substitute for equities, but they are an underappreciated complement — a tangible, finite, and historically significant asset class that can stand the test of time.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. The content is based on general research and may not be accurate, reliable, or up-to-date. Before making any financial decisions, it is recommended to consult with a professional financial advisor or conduct thorough research to verify the accuracy of the information presented. The author and publisher disclaim any liability for any financial losses or damages incurred as a result of relying on the information provided in this article. Readers are encouraged to independently verify the facts and information before making any financial decisions.